Y C SHUKLA

The Behavioral Astrologer

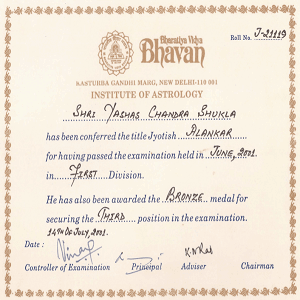

B.Tech, LLB, Jyotish Acharya (BVB, Delhi)

Best Astrologer Life Coach Legal Advisor Mentor Guide in India

SEBI Trained Investment Advisor

Former Asstt GM,

Powergrid Corporation of India

Why Choose Us

Certified Astrologer

Affordable Price

Reliable Service

100% Confidential

More Than 5000+ Customers Have Trusted Us For Quality Services

We are glad to be a part of countless success stories by providing the best quality services as Life Coach, Mentor, Astrologer and Guide in the time of crisis to our Clients. Y C Shukla is renowned as one of the Best Astrologer in India.

If you are searching a Life Coach, Mentor, Astrologer or Guide in the time of crisis, when nobody may help you in getting a clear picture of the future path, then you have come to the right website.

My name is Y C Shukla and I had voluntary retirement from post of Asst GM in Powergrid Corporation of India and NTPC in 2012 after 24 years working.

I have done B Tech (1988) from Lucknow University, PGDM (1995), LLB and a Jyotish Acharya Diploma in 2002 from Bhartiya Vidya Bhavan, New Delhi, under famous astrologer Sh K.N.Rao.

I applied my astrological learning in solving day to day problems in my personal and professional life for next 10 years and thereafter I started my own online consultation for astrology in 2013 at ycshukla.com. As an engineer, I believe in Behavioral Astrology as per prevailing planetary conditions in one’s chart to get benefited and avoid unnecessary situations and losses.

Being one of the best Astrologer in India as well as worldwide, I have advised few thousand clients in last 8 years of my Online Consultation and my most clients come from Corporate, NRI or professional background, who love to understand their astrological chart and get insight from planetary situation to modify their life in positive direction, instead of doing costly remedies of gemstone and Lal Kitab. Explanation is my forte and you are welcome to consult me if you like my approach. You may visit My Quora Answers for a glimpse of my way of consulting on astrology.

Shani Sadesati for Pisces, Dhaiya for Cancer & Scorpio Moonsign Starts from 18 January 2023.

Please Join, Subscribe and Like My YouTube Channel ↑

You Need To Know The Reason Behind Your Problem To Solve It At Root Level

Once Lord Buddha was sitting with a rope in his hand. His disciples were curious to know what he would do with that rope. He tied 3 knots in that rope and then asked his disciples “Is it the same rope now?” A disciple said “Though externally it appears changed due to 3 knots but internally, it remains the same rope.”

Then Lord Buddha said that he wanted to open up those 3 knots and for that he started pulling rope from both ends . After failing to untie the rope, he asked again” Can these knots be opened by pulling from both the ends ?”

The disciple said “No, No, that will further tighten the knots!”

Lord Buddha asked the disciple way to untie those knots.

The disciple said “To untie these knots, I will have to see how these knots were tied and then only we can untie them.”

Lord Buddha said “That is the fact which people do not understand! People want to solve their problems without knowing how the problem was created. They want instant solutions, without going deeper into their behaviour and want to untie the knots by pulling both ends forcefully, which only worsens the problem.”

Astrology helps in understanding how the problem was created. Every problem we face has two dimensions: At seed level and then at environment level. If these two do not match then crop would not grow. For seed, we need to know the horoscope and for environment, we need to know habits and working environment of a person.

Swami Sivananda tells sequence from Karma to Destiny in above image: Action→Tendency →Habit→Character→Destiny

And this destiny map is available like company’s annual balance sheet via our Birth Chart. If we want to change this destiny for better, we need to know current accumulation, habits, character which a birth chart clearly explains and then we need to change our actions & habits so that we can change our destiny.

That is why I do not recommend quick short cut remedies and recommend behaviour modification after looking at your chart to change destiny, similar to doctor recommending lifestyle changes based on your medical test report.

Visit on Quora

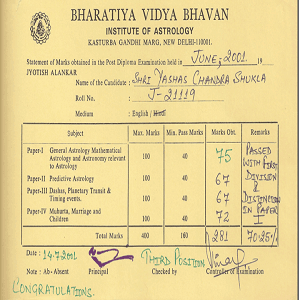

My Jyotish qualifications

Jyotish Alankar

Completed Jyotish Alankar Course from Institute of Astrology , Bhartiya Vidya Bhavan , New Delhi in June 2001.

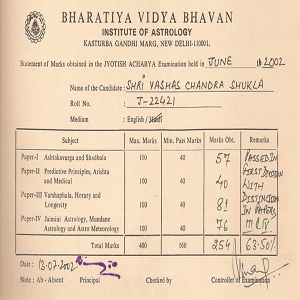

Jyotish Acharya

Completed Jyotish Acharya Course from Institute of Astrology , Bhartiya Vidya Bhavan , New Delhi in June 2002.

Bronze Medal in Jyotish Alankar

Awarded Bronze Medal in Jyotish Alankar Course by Respected Sh K.N. Rao

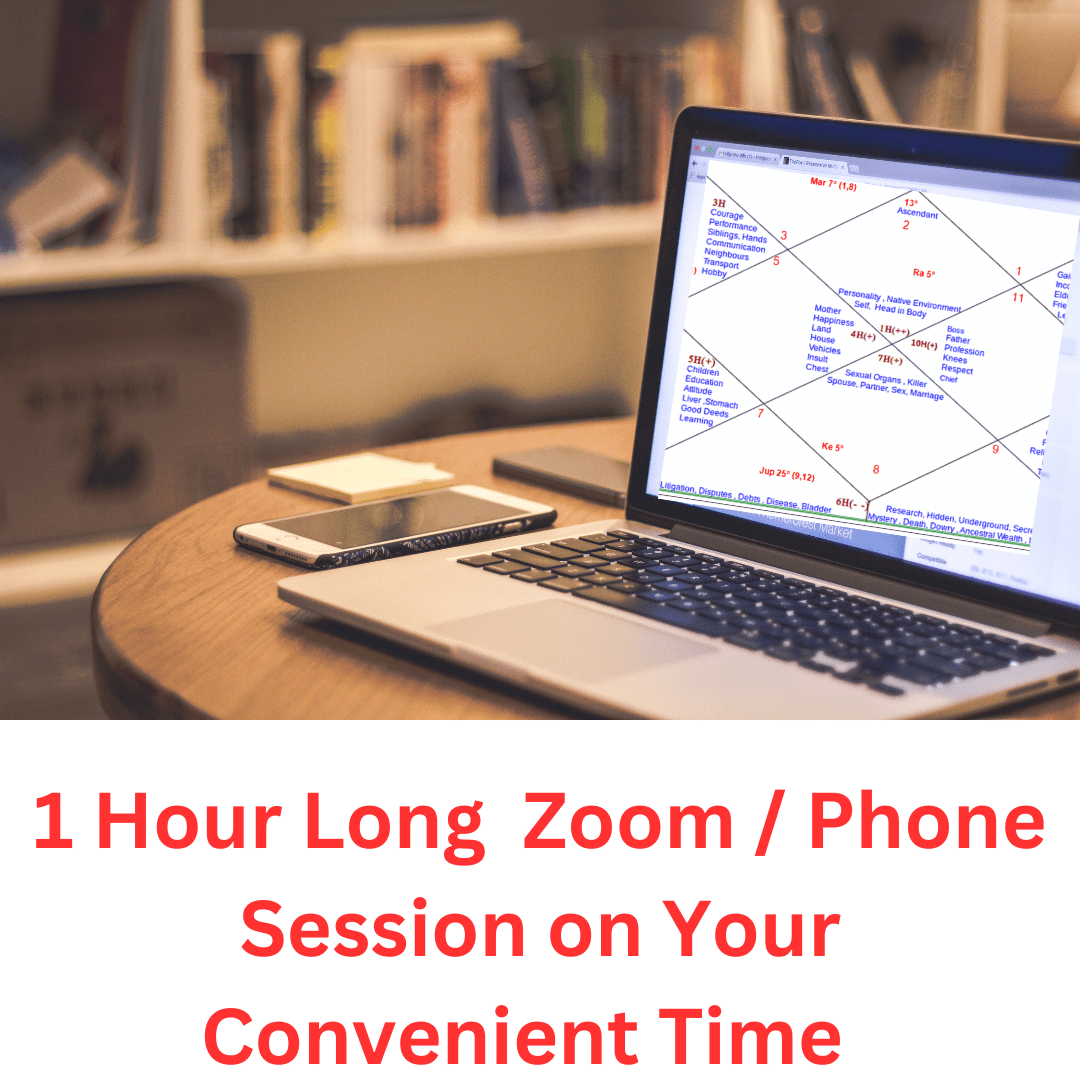

Make Your Kundli Here

Latest Tweets

Testimonials & Feedbacks from Global Professionals

What is Astrology?

Astrology is the oldest discipline studied all over the world, that claims to divine information about human affairs and terrestrial events . It is done by studying the movements and relative positions of planets with respect to stars, as seen from the Earth.

Astrology is based on the idea that there is a relationship between the positions of these celestial objects and events on Earth, and that this relationship can be used to predict and understand human behavior and events in personal life as well as mundane events.

History of Astrology

Astrology has been around for thousands of years and has been practiced by Indians, Chinese , Greek and Egyptians throughout history.

Though the modern science refuses to accept its existence, astrology remains a popular belief system for most people, who see it as a way to gain insights into their personalities, relationships, and life events. However, it is important to note that any insights gained from astrology are based purely on subjective interpretation , so modern science finds it difficult to treat it at par with physical sciences .

But we can safely compare it with modern economics , where mathematics and mathematical modelling are frequently used to predict the state of economy , which often go wrong , yet treated as a science.

India has a long and unbroken tradition of astrology from the time of Vedas, so one can find the best astrologer in India as compared to any other country.

What is Behavioral Astrology?

Behavioral astrology is a branch of astrology that focuses on how astrological signs and planetary positions can influence a person’s behavior and personality traits. According to this approach, each zodiac sign is associated with specific personality traits and tendencies, which can be further influenced by the positions of planets at the time of a person’s birth.

Proponents of behavioral astrology believe that by understanding a person’s astrological chart, they can gain insights into their strengths, weaknesses, and behaviors. They may use this information to provide guidance on relationships, career choices, and personal development. Moreover, the changing planetary positions call for changes in lifestyle and life goals , just like ageing changes our living style.

So, behavioral astrology advises a person to adapt to new situations as per prevailing planetary conditions in the horoscope by slowing down or accelerating the pace of working during a given period.

How to choose the Best Astrologer?

When searching for the best astrologer in India or any other country, it is important to do thorough research and consider various factors.

There are many astrologers, and it can be difficult to determine which ones are reputable and qualified. It is important to do own research and consider various factors when choosing the best astrologer in India. Some of the factors to consider include:

- Qualifications: Look for an astrologer who has a formal education in astrology or has been trained by a reputable astrological institution instead of believing that astrologer learned everything from his father.

- Experience: Choose an astrologer who has significant experience in the field and a track record of providing accurate and helpful guidance to clients . The astrologer should be of mature age with post qualification experience of at least 5-10 years. He should be able to explain his predictions based on astrological principles.

- Reputation: Look for an astrologer who has a good reputation and positive reviews from clients. You can check online reviews, ask for referrals, or check his predictions in social media , blog etc.

- Ethics: Choose an astrologer who adheres to ethical standards and does not engage in practices such as scare tactics or unethical marketing.

- Communication: Look for an astrologer who communicates well and is able to explain their methods and findings clearly to you. For this , see his / her blog , social media handles, Youtube vlogs etc.

Why Choose Astrologer Y.C.Shukla?

Jyotish Acharya Y C Shukla, Believer in Behavior Based Astrology, has helped more than 5,000+ professionals and NRIs in their personal and professional life. In 2000, he attended 2 years course of Jyotish Acharya from prestigious Institute of Astrology, Bhartiya Vidya Bhavan, New Delhi, run by World Renowned Astrologer Sh K N Rao. Apart from being a qualified astrologer, he has been an engineer in India’s National Power Transmission system and holds a B Tech and a Law degree .

Since more than a decade, clients from India, Australia, New Zealand, Singapore, Gulf Countries, UK, Germany, Belgium, Sweden, USA, Canada, Japan, China, Panama regularly consult him for his logical and practical advice suitable for their living conditions.

Being one of the Best Astrologer in India since last two decades, he has been regularly writing astrological essays and predictions on Quora. He has an exclusive space in English Behavioral Astrology and in Hindi Tarkik Jyotish to answer various questions connected to astrology.

Hits: 7124